How Long Does a Tesla Battery Last? - Their Rated Lifetime Mileage

Electric vehicles like Tesla replace the traditional combustion engine with electric motors and batteries.

Since electric motors have just a fraction of the moving parts of a combustion engine, the maintenance for electric vehicles is almost non-existent when compared to traditional vehicles.

Electric motors are extremely reliable and last a long time. So when someone is considering a Tesla or another electric vehicle, a common question is how long do the batteries last.

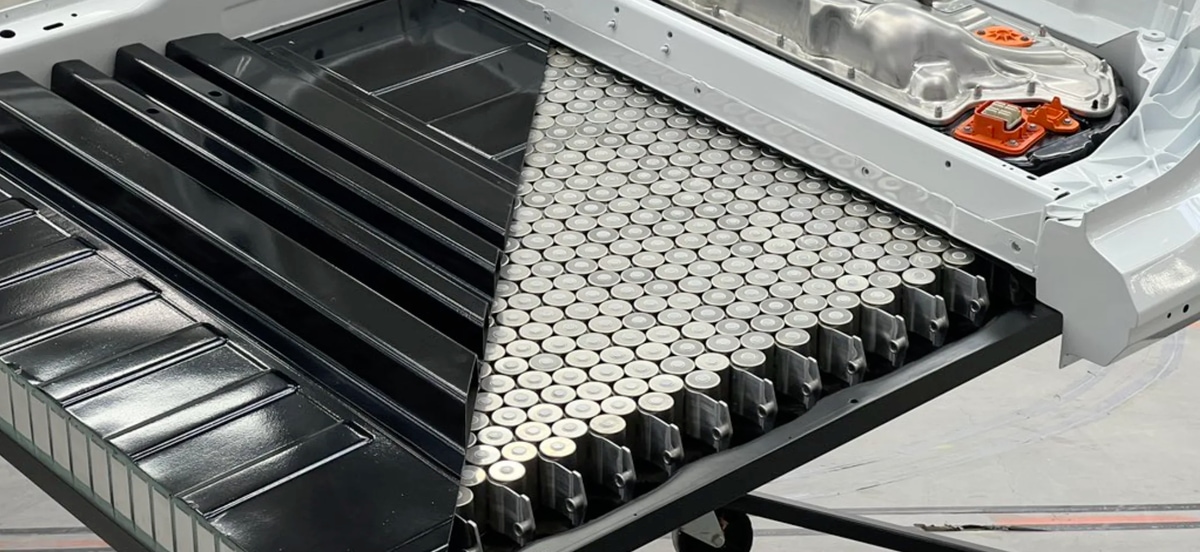

Teslas have large battery packs that give them a longer range than most electric vehicles. A Tesla battery pack can range from 65 kWh up to 100 kWh, giving some Teslas as much as 375 miles of range.

Factors That Affect Battery Life

How long an electric vehicle battery lasts will vary. There are various factors that will affect the lifespan of a battery. These factors fall into one of two categories, those under an owner’s control and those that are outside of our control, such as battery aging.

Lets first discuss those factors that we are in control of. A well maintained and cared for battery will increase its lifespan.

Avoid Low and High-State of Charges

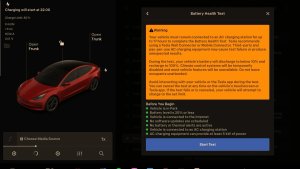

Lithium-ion batteries, which most Teslas use degrade faster when they are left at a very low state, or a very high state of charge for long periods of time. That means that an owner should avoid using the battery all the way down or charging it to 100% on a regular basis.

Most Teslas should also not be charged to 100% for everyday use. Charging a battery to 80 or 90% for day-to-day use will greatly increase the life of the battery. This doesn’t mean that you can’t charge the battery all the way to 100% occasionally. A good example of when you’d want to charge your battery all the way would be when going on a road trip. However, it should not be done on a regular basis.

The exception to this rule is electric cars with lithium iron phosphate batteries (LFP). LFP batteries use a different chemistry and are not affected by very low or high state of charges. Tesla currently uses LFP batteries in their standard range Model 3 and Model Y vehicles.

Temperature and Climate

The temperature of a battery will also affect its battery life. There is a certain temperature range that a battery should stay within to prevent degradation.

The safe temperature range will vary based on whether the battery is being actively used.

This is one area where Tesla sets itself apart from the competition. Some EVs do not have thermal management systems for their batteries, letting the battery get as hot or cold as its environment.

This puts a great deal of stress on the battery and will cause degradation if the battery is left in cold or hot environments for prolonged periods.

Lithium-ion batteries will start to degrade when exposed to temperatures under 32°F or above 80°F.

Without a thermal system the power output of the car is also limited in order to prevent the battery from overheating.

Teslas have the best thermal management in any car. What this means for you is not only will the battery last much longer than in other EVs, but it will also allow the car to charge quicker and have higher performance.

Tesla battery management is fantastic and it is completely automatic. In fact, owners can’t even tell when their car is managing their battery’s temperature. It happens all automatically, while driving, charging or even while their car is sitting in a parking lot.

Reducing Fast Charging

Another factor that plays a role in battery life is extremely fast charging. Charging the battery at lower voltages is generally better for the battery than higher voltages.

Although the negative effects of fast charging are less severe than leaving your battery with a high state of charge, they should be limited if possible. We would recommend not using Tesla Superchargers as your main form of charging your Tesla.

Fast Discharging

In a similar manner in which fast charging routinely can decrease battery life, fast discharging on a daily basis will also have an affect on battery life.

Everyday driving with the occasional spirited drive is unlikely to have any affect on your car’s battery life. However, if a vehicle is raced on a track on a regular basis, it could lead to some negative effects.

Although fast charging or discharging can affect a battery’s lifespan, they are not major contributors.

Battery Aging

There are various other factors that will affect the lifespan of a Tesla battery pack. Factors that we won’t have any control over.

The biggest one of these factors is the age of the battery. The age of the chemicals inside of the battery will play a large role in determining the battery’s usable life.

Although lithium-ion batteries start to age the day they’re created, they can last up to 20 years.

Charge Cycles

Charging and discharging a battery is known as a charge cycle. Charge cycles are a large contributor to the lifespan of a battery. It’s why many batteries are rated by the number of charge cycles they can support.

One charge cycle is equivalent to using an amount of energy that is equal to 100% of the battery capacity.

For example, if you charged a battery to 100% and discharged it down to 50% twice, then that would be equivalent to one charge cycle.

Although Tesla doesn’t specify the exact number of charge cycles for their batteries, it is believed that they will last up to 1,500 charge cycles.

What Happens When a Battery Ages

As a battery ages and degrades, it will start to hold less of a charge. A battery that has degraded, may only hold 90% of its original capacity and that capacity will continue to drop as the battery continues to age.

Eventually, the battery will no longer have a practical use in the vehicle and will need to be replaced after many years.

It’s normal for a new Tesla to lose some capacity in its first year. We’ve seen degradation rates of up to 5%. However the battery degradation will generally stabilize after the first year and the degradation rate will drop.

Conclusion

There are many factors that go into how long a Tesla lithium-ion battery will last. Mindful owners can reduce battery degradation and increase their lifespan properly maintaining their battery.

Owners can let Tesla manage their battery state by leaving the vehicle plugged in and not charging their cars all the way to 100% on a daily basis, unless of course they have a LFP battery.

However, there are other factors that will also have a big part in how long a Tesla battery lasts.

Since there are many factors that go into how long a Tesla battery will last, the exact mileage someone gets out of a Tesla battery will vary.

Since we know that newer Tesla batteries have a lifespan of about 1,500 charge cycles, we can use that to estimate the battery's lifetime mileage.

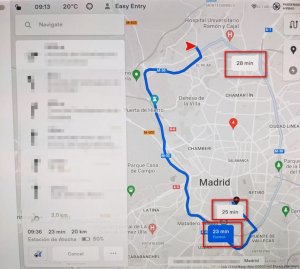

Taking charge cycles and the car's EPA mileage into account, we estimate that the lower range Model 3's battery will last about 400,000 miles.

While at the higher end, the Model S has a 375 mile range according to the EPA, bringing the battery's lifetime mileage up to 560,000 miles.

In 2019, Elon Musk commented on the Model 3's battery longevity, saying that the Model 3 has a battery that should last 300,000 to 500,000 miles.

Although the car's battery may last only 300,000 miles, other parts of the car are designed to last much longer. The car’s body and drive unit are made to last one million miles. So even after the battery needs to be replaced, the car still has a lot of life left.

The average person in the US drives an average of 14,000 miles per year. If a Tesla battery only lasted 300,000 miles, it would still last approximately 21 years for the average driver.

Although Tesla is at the forefront of electric vehicles and battery development, work continues to find batteries that last longer, are cheaper to produce and have higher capacities.

Battery Warranty

All Teslas come with the typical new car warranty. However, Tesla offers a separate, longer, battery and drive unit warranty.

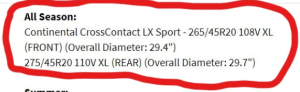

The exact battery warranty will vary slightly by model, but their terms are fairly similar. The warranties range from an 8 year or 100,000 mile warranty, all the way up to an 8 year or 150,000 mile warranty, whichever comes first.

The warranty is based on the battery holding a minimum of 70% of its capacity over the course of the 8 years.

Future

Battery technology has stayed stagnant for a long period of time. It’s only more recently that electronics and now electric vehicles are pushing for improved battery technology.

We’re likely to see tremendous improvements in battery technology over the coming years as companies figure out how to produce batteries with higher capacities and reduced weight.

Electric cars, boats and even planes will continue to push for improved battery technology.

Million Mile Battery

Tesla is currently developing higher capacity, structured battery packs that will decrease the weight of a vehicle, leading to better efficiency.

One of Tesla’s goals with its new battery technology is to have a battery that will last one million miles.

Real World Battery Lifespan

Tesla released their first Model S in 2012, so there are now various Teslas with high mileage that give us a better idea of how long a Tesla battery will last in the real world.

Tesloop, a company that offers one-way Tesla rentals between major cities has several Teslas with high mileage. One of their vehicles racked up more than 400,000 miles, although the battery did need to be changed at 317,000 miles.

Another owner, Hansjörg Gemmingen has almost 900,000 miles on his 2013 Model S. His car has gone through two battery replacements during this time, but it’s a true testament to the longevity of Tesla’s batteries.

Keep in mind that these vehicles are 8 and 9 years old now and Tesla had only been creating cars for a few years when the vehicles were built.

Tesla has undoubtedly learned and improved their products since these early vehicles. We'd expect newer batteries to last even longer.

![Tesla's 2025 Q1 Earnings Call: How to Listen [Listen to Replay]](https://www.notateslaapp.com/img/containers/article_images/multiple-models/group_81.jpg/b2695a53b51e4c7927802deba2534b09/group_81.jpg)

_300w.png)

![Tesla’s Hollywood Diner: In-Car Controls & Theater Screens Turned On [VIDEO]](https://www.notateslaapp.com/img/containers/article_images/2025/tesla-diner.webp/3aaa2ea0edf2eaa0fabe1217530f3476/tesla-diner.jpg)